Goodbye red tape, and hello effortless payments.

Takes 30 sec.

Experts in all Risk Levels

No Hidden Fees

Easy Integration With Existing Systems

Trusted By Thousands (0% Markup)

Merchants Helped

Team Members

Verticals Supported

Annual Volume

Effective Rate:

The effective rate is the actual percentage you pay in credit card fees on your total sales. It's calculated as:

Effective Rate = (Credit Card Fees / Total Sales) × 100

Ideal effective rates in the industry:

- Excellent: Less than 1.5%

- Needs improvement: More than 1.6%

This calculator helps you determine your current effective rate and provides recommendations based on industry benchmarks.

Hear From Our Clients

Discover how our seamless solutions have transformed businesses just like yours.

Trustindex verifies that the original source of the review is Google. Reliable and professional merchant services – highly recommend! We've been using DigiPayTec for our payment processing needs, and the experience has been excellent from day one. Their team is knowledgeable, responsive, and truly focused on customer support. The onboarding process was smooth, and they helped us set up everything quickly with no disruption to our business.Trustindex verifies that the original source of the review is Google. Excellent POS System – Streamlined and Reliable We've been using this POS system in our café for over six months now, and it's been a game changer. The interface is user-friendly, allowing even new staff to learn it quickly. Order-taking is smooth and intuitive, and the integration with our kitchen printer and inventory system keeps everything running like clockwork. We especially love the real-time sales reporting—it helps us make informed decisions daily. Highly recommend for small to mid-sized cafés looking for efficiency and ease of use.Trustindex verifies that the original source of the review is Google. Very good customer service and addresses all your needs and wants for your business in a very timely manner! Client satisfaction is their number one priority.Trustindex verifies that the original source of the review is Google. HIGHLY RECOMMEND! For my cake-making business, they got me set up with everything I needed to start taking payments, both in person and online. Additionally, since that time, they have been very patient and responsive to all of my follow-up questions.

How DigiPayTec Helps You Navigate the Approval Process

Small business payment processing growth.

By Phase

Simplify every stage of your payment process, from setup to settlement, with solutions tailored to fit your business needs.

- Streamlined onboarding process

- Efficient transaction tracking

- Seamless payment settlement

By Hardware

Empower your business with the latest hardware designed to ensure secure and hassle-free transactions for every customer.

- Modern payment terminals

- Contactless payment options

- Reliable, user-friendly devices

By Environment

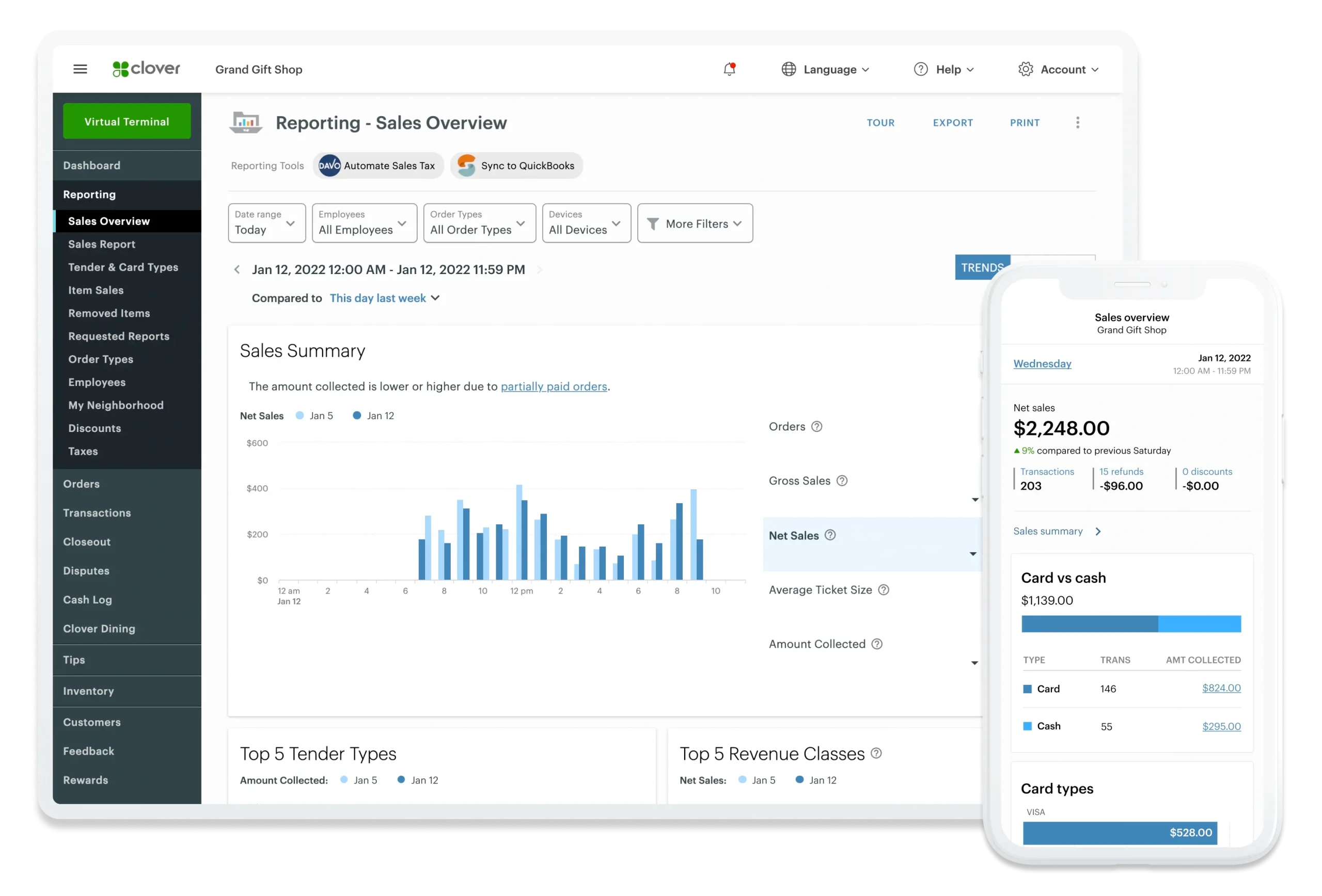

Adapt to any business environment with flexible solutions that support in-store, online, and mobile transactions.

- Scalable payment systems

- Omni-channel compatibility

- Secure mobile processing

By Payment Gateways

Integrate powerful payment gateways to optimize transaction speed and security while enhancing customer experiences.

- Robust fraud protection

- Multi-currency acceptance

- API-ready integrations

Low Risk

For businesses with steady revenue and minimal chargeback risks, Payment Nerds provides reliable, secure, and cost-effective payment solutions. Benefit from competitive rates, quick approvals, and hassle-free integration to keep your operations running smoothly.

- Competitive transaction rates

- Fast account approvals

- Seamless platform integration

- Enhanced payment security

- Streamlined onboarding process

- Robust reporting tools

- 24/7 support availability

- Scalable for future growte

Low Risk

Medium Risk

For businesses in industries with moderate chargeback rates or regulatory requirements, Payment Nerds offers tailored solutions that balance security with flexibility. Get the tools and support you need to manage transactions efficiently while minimizing risks.

- Customizable fraud protection

- Flexible processing options

- Scalable payment platforms

- Detailed chargeback management

- Competitive processing rates

- Multi-channel transaction support

- Expert consultation services

Medium Risk

High Risk

For industries facing elevated chargeback rates or regulatory hurdles, Payment Nerds specializes in high-risk payment processing with advanced security measures and robust support. Keep your business thriving with secure and reliable solutions.

- Advanced fraud detection tools

- Chargeback reduction strategies

- High approval rates

- Specialized risk management support

- Regulatory compliance guidance

- Flexible integration options

- Dedicated account managers

- Support for global transactions

High Risk

Mobile Payments Made Easy

Process payments on the go with portable devices, giving you flexibility and accessibility no matter where business takes you.

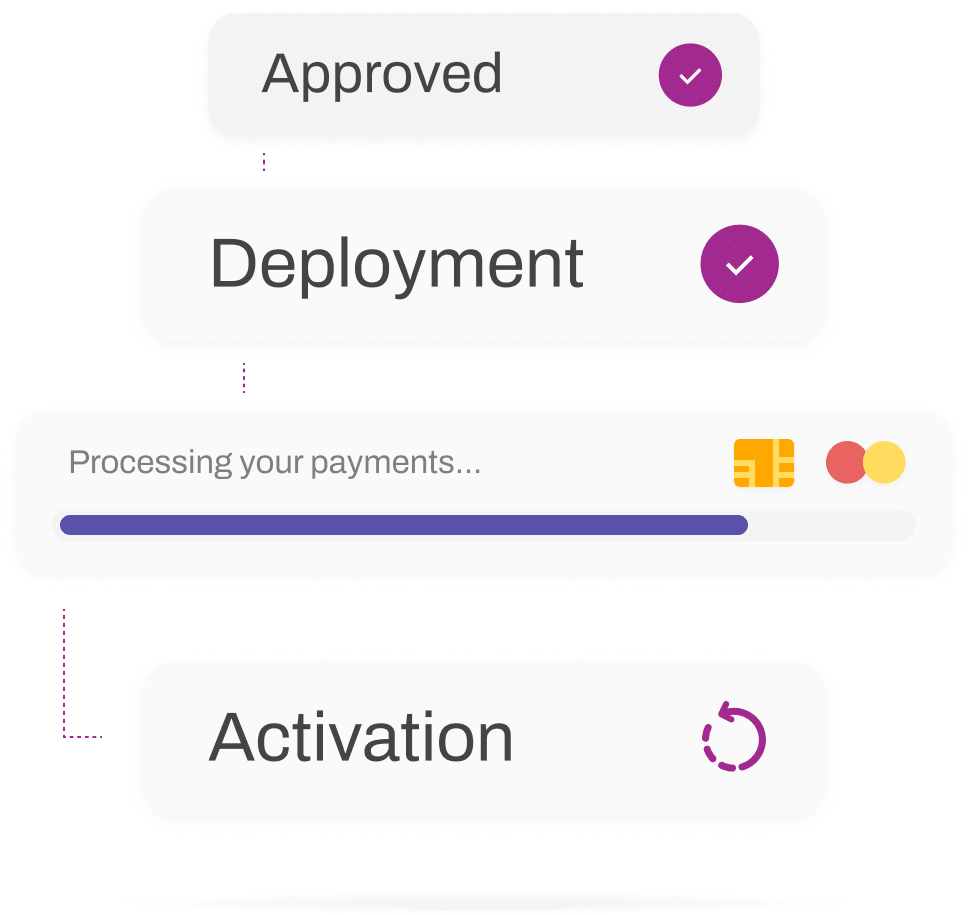

Create tailored reports to uncover key business insights. Analyze daily sales, payment methods, or customer trends effortlessly to make data-driven decisions.

Treasury Solutions to Optimize Your Business Finances

Manage payments, track transactions, and access financial insights anytime, anywhere with our secure online and mobile banking solutions. Stay in control of your business finances with user-friendly tools designed for modern commerce.

Powerful APIs for Seamless Payment Integration

Powerful APIs for Seamless Payment Integration

Comprehensive Documentation

- Meticulously crafted to provide clear guidance for developers from setup to advanced configurations

- Includes code samples, troubleshooting tips, and best practices

- Facilitates smooth and efficient integration with minimal friction

- Helps businesses go live faster

Real-Time Payment Processing

- Instant transactions to enhance customer satisfaction

- Immediate payment verification for optimized cash flow

- Reduces the risk of failed transactions and delays

Customizable Solutions

- Flexible APIs tailored to your business needs

- Create custom workflows and branding options

- Seamless and personalized customer experiences

Articles & Resources

Showcasing Our Global Expertise

Top 5 Payment Processing Solutions for Small Businesses

- Posted by nizal85

Understanding Merchant Services: A Beginner’s Guide

- Posted by nizal85

5 Industries Most Influenced by Negative Reviews

- Posted by Digi PayTec

7 Local Search And Review Trends To Watch In 2021

- Posted by Digi PayTec

4 Ways Real Estate Agent Reviews Can Fill More Homes

- Posted by Digi PayTec

Why Law Firms Need Online Reviews

- Posted by Digi PayTec

Violations that Qualify Online Reviews for Removal

- Posted by Digi PayTec

7 Reasons Why Online Reviews Are Vital to Your Business

- Posted by Digi PayTec

Defend Your Online Business From Bad Review Bots

- Posted by Digi PayTec

7 Ways To Deal With Bad Reviews Written By Your Competitors

- Posted by Digi PayTec

5 Ways To Encourage Great Online Reviews

- Posted by Digi PayTec

9 Ways You Can Identify A Fake Review

- Posted by Digi PayTec

Tailored Solutions

Reasons why pick Digipaytec

Legal Industry Compliance

DigiPayTec supports IOLTA / trust account compliance, PCI DSS, and data privacy regulations.

Integrations with legal billing software (e.g., Clio, MyCase, PracticePanther)

Faster Payments, Better Cash Flow

Accept payments via credit card, ACH, and eCheck to speed up receivables.

Next-day funding or fast payout features.

Reduce accounts receivable backlog.

Client Convenience

“Make It Easy for Clients to Pay — From Anywhere” Offer secure payment links, client portals, mobile payments, or QR code billing. Enables retainer deposits and recurring billing for ongoing services.

Professional Branding + Custom Invoicing

Branded checkout experience reinforces your firm's professionalism. Customizable invoices that reflect your services (e.g., hourly billing, flat fees).

Security and Trust

Bank-grade encryption and fraud protection tools. Highlight that payment processes are safe for both the company and its clients.

Detailed Reporting and Reconciliation

Easy integration with accounting software (e.g., QuickBooks). Transparent fee structures and real-time dashboards.

Seamless Integration with Software

Plug-and-play setup with leading legal CRMs or case management systems.

Customer Satisfaction Guarantee

We’re committed to helping your business succeed. If you're not completely satisfied, we’ll work with you to make it right! Your satisfaction is our top priority.

White-Glove Setup & Support

Dedicated onboarding for legal practices. Live support for payment disputes, chargebacks, or setup.

Does your business currently accept card payments?

YES

NO

How do you want to accept card payments?

you can select more options*

In-person

Online

On phone

What is your monthly processing volume?

Please write your business name

Upload latest merchant statement for faster approval (optional)

Please write your contact information

The final estimated price is :

Summary

| Description | Information | Quantity | Price |

|---|---|---|---|

| Discount : | |||

| Total : | |||

FAQ's

We work with a variety of businesses across industries, including retail, e-commerce, hospitality, and more. Whether you’re a low-risk, medium-risk, or high-risk business, we have tailored solutions to meet your payment processing needs.

Yes, our solutions are built with advanced security features like tokenization, encryption, and PCI DSS compliance to protect sensitive data and safeguard your transactions.

Absolutely! Our APIs and payment gateways are designed to integrate seamlessly with your current systems, ensuring a smooth transition without disrupting your operations.

Still have a question?

Contact us today for personalized assistance—our team is here to help with anything you need!

Compact

Compact Flex

Flex Flex Pocket

Flex Pocket Go

Go Kiosk

Kiosk Kitchen Display System

Kitchen Display System Mini

Mini Station Duo

Station Duo Station Solo

Station Solo